Weather and climate news

-

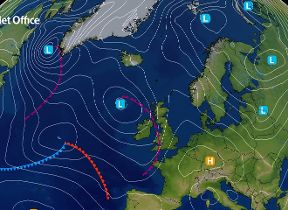

LatestA sunny but cold Valentine's Day for manyColder air is pushing south across the UK, bringing a brief settled spell for Saturday before further rain and wintry hazards arrive later.Read more

LatestA sunny but cold Valentine's Day for manyColder air is pushing south across the UK, bringing a brief settled spell for Saturday before further rain and wintry hazards arrive later.Read more -

LatestIs the rain’s reign coming to an end?Following seemingly incessant rainfall for many locations in the UK, there is a brief respite as colder conditions will temporarily take charge.Read more

LatestIs the rain’s reign coming to an end?Following seemingly incessant rainfall for many locations in the UK, there is a brief respite as colder conditions will temporarily take charge.Read more -

LatestMet Office launches major upgrade to forecasting systemThe Met Office has launched its most significant scientific upgrade in more than three years, a major step forward for the UK’s weather and climate science capability.Read more

LatestMet Office launches major upgrade to forecasting systemThe Met Office has launched its most significant scientific upgrade in more than three years, a major step forward for the UK’s weather and climate science capability.Read more -

LatestMet Office science helps protect UK plants from rising pest risksThe UK temperature is rising and that brings the risk of new pests becoming established in the UK, posing threats to agriculture and forestry warns the Met Office.Read more

LatestMet Office science helps protect UK plants from rising pest risksThe UK temperature is rising and that brings the risk of new pests becoming established in the UK, posing threats to agriculture and forestry warns the Met Office.Read more

973 news items